Princeton Packet

3 July, 1987

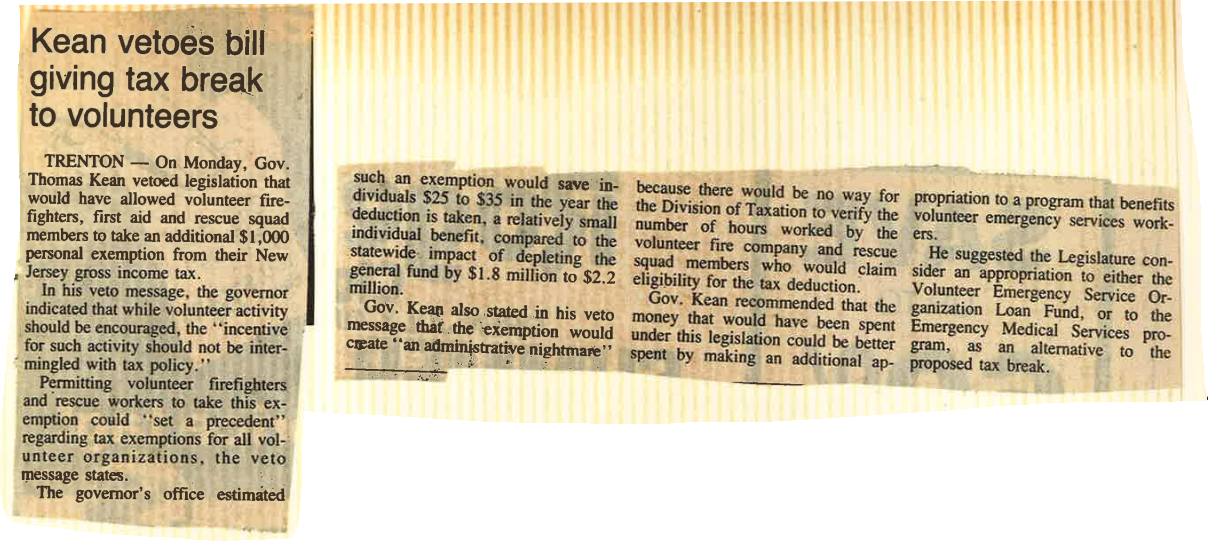

Kean vetoes bill giving tax break to volunteers

TRENTON — On Monday, Gov. Thomas Kean vetoed legislation that would have allowed volunteer fire-fighters, first and and rescue squad members to take an additional $1,000 personal exemption from their New Jersey gross income tax.

In his veto message, the governor indicated that while volunteer activity should be encouraged, the “incentive for such activity should not be intermingled with tax policy.”

Permitting volunteer firefighters and rescue workers to take this exemption could –set a precedent” regarding tax exemptions for all volunteer organizations, the veto message states.

The governor’s office estimated such an exemption would save individuals $25 to $35 in the year the deduction is taken, a relatively small individual benefit, compared to the statewide impact of depleting the general fund by $1.8 million to $2.2 million.

Gov. Kean also stated in his veto message that the exemption would create “an administrative nightmare” because there would be no way for the Division of Taxation to verify the number of hours worked by the volunteer fire company and rescue squad members who would claim eligibility for the tax deduction.

Gov. Kean recommended that the money that would have been spent under this legislation could be better spent by making an additional appropriation to a program that benefits volunteer emergency services workers.

He suggested the Legislature consider an appropriation to either the Volunteer Emergency Service Organization Loan Fund, or to the Emergency Medical Services program, as an alternative to the proposed tax break.